For each additional unit sold, the loss typically is lessened until it reaches the break-even point. At this stage, the company is theoretically realizing neither a profit nor a loss. After the next sale beyond the break-even point, the company will begin to make a profit, and the profit will continue to increase as more units are sold. While there are exceptions and complications that could be incorporated, these are the general guidelines for break-even analysis.

Break-Even Point (BEP) Calculator

Break-even analysis is an important way to help calculate the risks involved in your endeavor and determine whether they’re worthwhile before you invest in the process. When analyzing your break-even point, not only do you want to see that your business is breaking even, you’re looking to make sure your business is profitable as well. Here are a few ways to lower your break-even point and increase your profit margin. Break-even analysis, also known as break-even point analysis, involves calculating the point at which a business breaks even and what steps it might take to become profitable. If the revenues earned are a main activity of the business, they are considered to be operating revenues.

What is the break-even point for a business?

Say your variable costs decrease to $10 per unit, and your fixed costs and sales price per unit stay the same. Determining an accurate price for a product or service requires a detailed analysis of both the cost and how the cost changes as the volume increases. This analysis includes the timing of both costs and receipts for payment, as well as how these costs will be financed. An example is an IT service contract for a corporation where the costs will be frontloaded. When costs or activities are frontloaded, a greater proportion of the costs or activities occur in an earlier stage of the project.

What Is the Breakeven Point (BEP)?

A higher contribution reduces the number of units needed to break even because each unit contributes more towards covering fixed costs. Conversely, a lower contribution margin increases the breakeven point, requiring more units to be sold to cover fixed costs. This calculation demonstrates that Hicks would need to sell 725 units at $100 a unit to generate $72,500 in sales to earn $24,000 in after-tax profits. As you can see, when Hicks sells \(225\) Blue Jay Model birdbaths, they will make no profit, but will not suffer a loss because all of their fixed expenses are covered.

Break-even point in units

In particular, the break-even must have a point of comparison, and it does not provide information about the viability of the business. To illustrate the concepts of break-even point, consider the following example. Even though break-even analysis can help forge a path to profitability, it’s not a perfect analytical tool.

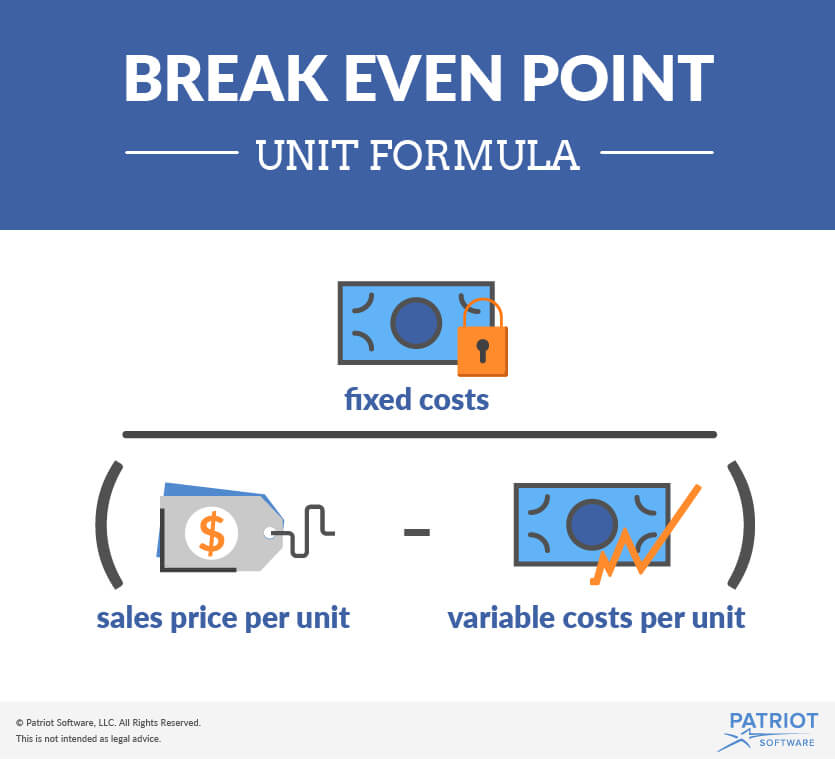

Calculating the break-even point in number of units

We are not to be held responsible for any resulting damages from proper or improper use of the service. The break-even point is an extremely important starting goal to work towards. No matter whether you are a business owner, accountant, entrepreneur or even a marketing specialist – you will often come across this metric, which is why our online calculator is so handy. Here are four ways businesses can benefit from break-even analysis.

- In the section opener, you explored a possibility where your industry had total monthly sales of 1,000 units and you faced eight competitors.

- Once you determine that number, you should take a hard look at all your costs — from rent to labor to materials — as well as your pricing structure.

- Let’s say that we have a company that sells products priced at $20.00 per unit, so revenue will be equal to the number of units sold multiplied by the $20.00 price tag.

- Typically, the first time you reach a break-even point means a positive turn for your business.

On the other hand, variable costs are largely dependent on the volume of work at hand – if you have more clients, you will need more labor and materials which results in an increase in variable expenses. If you are starting your own business and head to the bank to initiate a start-up loan, one of the first questions the banker will ask you is your break-even point. This break-even point is the level of output (in units or dollars) at which all costs are paid but no profits are earned, resulting in a net income equal to zero. To determine the break-even point, you can calculate a break-even analysis in two different ways, involving either the number of units sold or the total revenue in dollars. This margin indicates how much of each unit’s sales revenue contributes to covering fixed costs and generating profit once fixed costs are met. For example, if a product sells for $10 but only incurs $3 of variable costs per unit, the product has a contribution margin of $7.

This means that the investor has the right to buy 100 shares of Apple at $170 per share at any time before the options expire. The breakeven point for the call option is the $170 strike price plus the $5 call premium, flat tax impact on saving and the economy or $175. If the stock is trading below this, then the benefit of the option has not exceeded its cost. Watch this video of an example of performing the first steps of cost-volume-profit analysis to learn more.

What happens when Hicks has a busy month and sells \(300\) Blue Jay birdbaths? We have already established that the contribution margin from \(225\) units will put them at break-even. When sales exceed the break-even point the unit contribution margin from the additional units will go toward profit. At \(175\) units (\(\$17,500\) in sales), Hicks does not generate enough sales revenue to cover their fixed expenses and they suffer a loss of \(\$4,000\). In this case, you estimate how many units you need to sell, before you can start having actual profit. The fixed costs are a total of all FC, whereas the price and variable costs are measured per unit.

Where the contribution margin ratio is equal to the contribution margin divided by the revenue. Our break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances. In effect, the insights derived from performing break-even analysis enables a company’s management team to set more concrete sales goals since a specific number to target was determined. He is considering introducing a new soft drink, called Sam’s Silly Soda. He wants to know what kind of impact this new drink will have on the company’s finances.