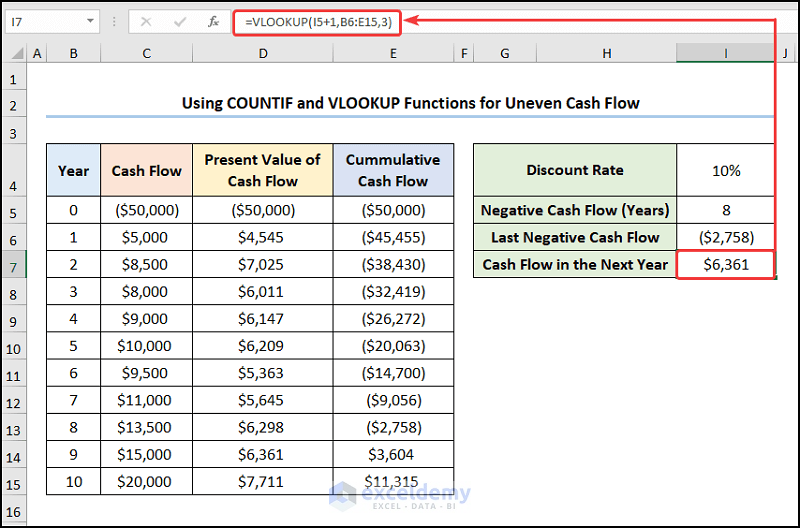

Both Fixed and the Uneven cash flow amounts help determine the NPV (Net Present Value) of an investment. There are many sources of Uneven Cash flows, like different types of assets or bonds that don’t return interest regularly, also known as “non-conventional bonds” or “vanilla bonds”. The fractional period is the ratio of the last negative cash flow against the cash flow in the year after. As this value denotes a period, it can’t be negative, so we utilize the ABS function to calculate the fractional period. By calculating how fast a business can get its money back on a project or investment, it can compare that number to other projects to see which one involves less risk. The longer an asset takes to pay back its investment, the higher the risk a company is assuming.

- Then, using the IF function, we will calculate our desired payback period.

- This period does not account for what happens after payback occurs.

- For this purpose, two types of machines are available in the market – Machine X and Machine Y. Machine X would cost $18,000 where as Machine Y would cost $15,000.

- The study of cash flow provides a general indication of solvency; generally, having adequate cash reserves is a positive sign of financial health for an individual or organization.

Formula

For lower return projects, management will only accept the project if the risk is low which means payback period must be short. Finally, we can determine the total payback period by adding the negative cash flow years and fractional period. Uneven cash flows can be defined as a series of unequal payments paid over a given period. The cash flow changes from time to time, so there is no fixed repayment amount. For example, a series of payments of $2000, $5000, $3000, and $2500 over 4 different years can be defined as uneven cash flows.

Payback Period Calculator

Her expertise is in personal finance and investing, and real estate. Our table lists each of the years in the rows and then has three columns.

Investment

We will take some uneven cash flows and create cumulative cash flows. Then, using the IF function, we will calculate our desired payback period. Once you have entered all the numbers as stated above, click on “Calculate” button. This means that your investment will take approximately 3.875 years to get your initial investment of $ 2,500 back. Additionally, if you click on the fixed CF tab, you need to only define one cash flow assuming that this cash flow will be fixed.

What Is the Formula for Payback Period in Excel?

In the financial world, understanding how to calculate the payback period is crucial for evaluating an investment or a project. The payback period is the time taken to recover the initial investment cost through the cash inflows generated by the project. When a project has uneven cash flows, calculating the payback period can be a little more challenging, but it’s still possible. In this article, we will discuss how to calculate the payback period with uneven cash flows. The discounted payback period is the number of years it takes to pay back the initial investment after discounting cash flows.

Consider a company that is deciding on whether to buy a new machine. Management will need to know how long it will take to get their money back from the cash flow generated by that asset. The calculation is simple, and payback periods are expressed in years.

It is a rate that is applied to future payments in order to compute the present value or subsequent value of said future payments. For example, an investor may determine the net present value (NPV) of investing in something by discounting the cash what is the difference between a lease and a loan flows they expect to receive in the future using an appropriate discount rate. It’s similar to determining how much money the investor currently needs to invest at this same rate in order to get the same cash flows at the same time in the future.

You might one to know how many years you need for this investment to pay back. This calculation can be further complicated by the irregular cash flows that you receive. The shortest payback period is generally considered to be the most acceptable.

The NPV is the difference between the present value of cash coming in and the current value of cash going out over a period of time. The payback period is the amount of time it takes to recover the cost of an investment. Simply put, it is the length of time an investment reaches a breakeven point. The discounted payback period of 7.27 years is longer than the 5 years as calculated by the regular payback period because the time value of money is factored in.