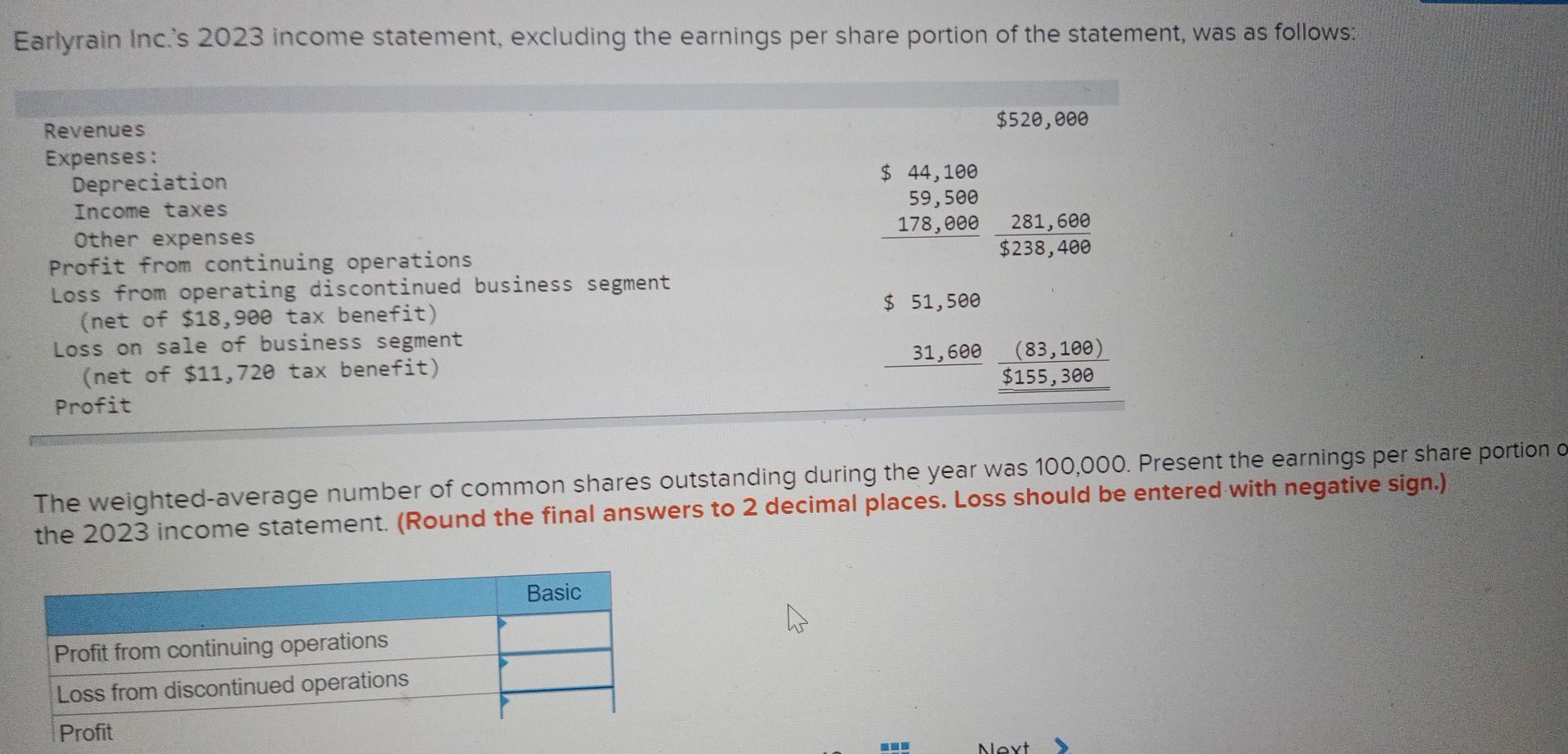

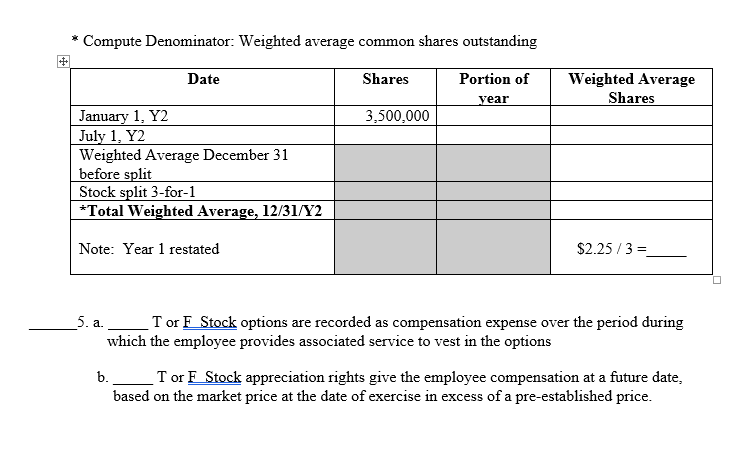

Weighted average outstanding shares are an important factor during the calculation of earnings per share for the Company. Investors may choose to use weighted averages if they have compiled a position in a particular stock over a period. Given continuously changing stock prices, the investor will calculate a weighted average of the share price paid for the shares. To calculate the weighted average cost per share, the investor can multiply the number of shares acquired at each price by that price, add those values, and then divide the total value by the total number of shares. Outstanding shares represent a company’s shares that are held by investors, whether they’re individual, institutional, or insiders. Investors can find the total number of outstanding shares a company has on its balance sheet.

What is a weighted average?

These include changes that take place because of stock splits and reverse stock splits. There are also considerations to a company’s outstanding shares if they’re blue chips. A stock split increases the number of outstanding shares but requires adjusting WASO to ensure comparability across reporting periods, as the company’s value doesn’t change. To sum it up, a weighted average of a company’s outstanding shares gives a more accurate picture of how much a company earned for its investors over a specified time period. It takes into account changes in the company’s outstanding shares over time and better reflects how much profit the company produced per share.

Pocket Calculator

Investors calculate the cost basis to determine if their investment has been profitable or not, along with any possible taxes they might owe on the investment. This is the number of shares outstanding after the beginning and all entered stock transactions have been accounted for. In the row directly below this line, select the ending date of the period you are calculating outstanding shares for. The weighted average provides a more precise reflection of the company’s share structure over time, taking into account not just the number of shares but also the duration they’ve been outstanding.

Outstanding Shares and Share Repurchase Programs

The weighted average shares outstanding, or the weighted average of outstanding shares, takes into consideration any changes in the number of outstanding shares over a specific reporting period. In effect, it weights any change in the number of shares outstanding according to the length of time that change was in effect. This potentially large range is the reason why a weighted average is used, as it ensures that financial calculations will be as accurate as possible in the event that the amount of a company’s shares changes over time. The weighted average number of outstanding shares in our example would be 150,000 shares. The weighted average of shares outstanding is calculated based on the volumes of various share sales and purchases over a period of time.

The weighted average is a significant number because companies use it to calculate key financial measures with greater accuracy, such as earnings per share (EPS) for the time period. Companies typically issue shares when they raise capital through equity financing or when they exercise topic no 458 educator expense deduction employee stock options (ESOs) or other financial instruments. Outstanding shares decrease if the company buys back its shares under a share repurchase program. Dilution occurs when a company issues additional shares, reducing current investors’ proportional ownership in the company.

- In above example, notice that Maria Company has adjusted all shares that exist prior to stock dividend (i.e., from January 1 to June 1).

- Because investors frequently purchase shares of a company at various times and in various amounts as they build their position in a stock, it can be a challenge to keep track of the cost basis of those shares.

- At the beginning of the second quarter, debenture holders of the company decided to convert their holdings into equity shares totaling 100,000 shares.

- Weighted average shares outstanding is the process of weighting every number of common stock to reflect how much time they were in effect.

How to Calculate the Weighted Average of Outstanding Shares

One method is for the investor to calculate a weighted average of the share price paid for the shares. The investor would multiply the number of shares acquired at each price by that price and then add those values together. Lastly, divide the total value by the total number of shares purchased to arrive at the weighted average share price.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. In this case, group 1 consists of 200,000 shares deemed to have been outstanding from 1 January to 31 December. For the denominator to be consistent with the numerator, it should reflect the earning power resulting from the issuances of new shares or the retirement of old shares.

In order to save your entries for your next visit, you will need to create (or save an existing) data record under the Data tab before closing or leaving this page. Note that this date selection will need to come before all other dates selected in the remainder of the calculator. A Data Record is a set of calculator entries that are stored in your web browser’s Local Storage. If a Data Record is currently selected in the “Data” tab, this line will list the name you gave to that data record.

She has worked in multiple cities covering breaking news, politics, education, and more. This journey through the nuances of WASO not only clarifies its importance but also empowers investors and analysts to make informed decisions. Ask a question about your financial situation providing as much detail as possible. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.